If you are not being updated with technology then you are out of business.

Let's look at history where technology has wiped off few business from the face of the earth.

Case Study on Business Strategies: Kodak’s Transition to Digital

Let's look at history where technology has wiped off few business from the face of the earth.

Case Study on Business Strategies: Kodak’s Transition to Digital

Kodak is one of the oldest companies on the photography market, established more than 100 years ago. This was the iconic, American organization, always on the position of the leader. Its cameras and films have become know all over the world for its innovations. Kodak’s strength was it brand – one of the most recognizable and resources, that enabled creating new technologies. Since the formation of Kodak, the company has remained the world’s leading film provider with virtually no competitors. That is until the arrival of Fuji Photo Film, which now surpasses Kodak in earnings per share and is viewed as the industries number two. It is evident that there has been a significant shift from the use of traditional film cameras to a market fully fledged and saturated with modern and updated digital cameras and digital photographic tools.

However over the time, the situation started to change for Kodak, as it has underestimated the changes on the market. There has been a significant shift from the use of traditional film cameras to a market fully fledged and saturated with modern and updated digital cameras and digital photographic tools. The age of digital technologies were emerging. The core business of Kodak- the film business, started to decline and some areas of the business started to be less profitable and filled with many competitors, especially cheap ones from Asia. Also, the prices of the digital cameras were falling.

Eastman Kodak is divided into three major areas of production.

- Kodak’s Digital and Film Imaging Systems section produces digital and traditional film cameras for consumers, professional photographers, and the entertainment industry.

- Health Imaging caters to the health care market by creating health imaging products such as medical films, chemicals, and processing equipment.

- The Commercial Imaging group produces aerial, industrial, graphic, and micrographic films, inkjet printers, scanners, and digital printing equipment to target commercial and industrial printing, banking, and insurance markets.

Issues and Challenges

The main issue behind this case is the problems faced by the Eastman Kodak Company in the process of changing to Digital technology in printing. It failed to establish market share and market leadership in the Digital sector. It is threatened with either immediate or rapid diversification in technology. Kodak has been extremely successful over the last century in film sales and film development. Now the time has come for the Eastman Kodak to respond to the challenges of digital cameras and also contemplate other issues as follows:

- Will the company’s current strengths and capabilities to make Kodak as ‘The Picture Company”?

- How serious are the weakness and competitive deficiencies?

- Does the company have attractive market opportunities that are well suited with Kodak’s resources? Does it have the internal resources to continue spending money investing in new technology?

- What type of strategy should it use to enter the digital camera business and how will Kodak leverage its strategic resources?

- Should it continue to research and produce digital camera technology alone, or look for partners?

- How will it cope with their existing and new competitors and how will it build a strategic advantage over other companies? Can Kodak once again dominate the world market?

What went wrong at Kodak?

Kodak started facing difficulties in 1984, when the Japanese firm Fuji Photo Film Co. invaded on Kodak’s market share as customers switched to their products after launching a 400-speed color film that was 20% cheaper than Kodak’s. Secondly, during 1980s the company failed to recognize the change in the environment and instead followed and sticked to a business model that was no longer valid for the post-digital age. After the management realized the change and react accordingly but it was too late.

Kodak’s strength

Kodak’s strength can take several forms as follows:

- Will the company’s current strengths and capabilities to make Kodak as ‘The Picture Company”?

- How serious are the weakness and competitive deficiencies?

- Does the company have attractive market opportunities that are well suited with Kodak’s resources? Does it have the internal resources to continue spending money investing in new technology?

- What type of strategy should it use to enter the digital camera business and how will Kodak leverage its strategic resources?

- Should it continue to research and produce digital camera technology alone, or look for partners?

- How will it cope with their existing and new competitors and how will it build a strategic advantage over other companies? Can Kodak once again dominate the world market?

What went wrong at Kodak?

Kodak started facing difficulties in 1984, when the Japanese firm Fuji Photo Film Co. invaded on Kodak’s market share as customers switched to their products after launching a 400-speed color film that was 20% cheaper than Kodak’s. Secondly, during 1980s the company failed to recognize the change in the environment and instead followed and sticked to a business model that was no longer valid for the post-digital age. After the management realized the change and react accordingly but it was too late.

Kodak’s strength

Kodak’s strength can take several forms as follows:

- Valuable intangible assets: Kodak’s strengths were its brand equity and distribution presence. After almost a century of global leadership in the photographic industry, Kodak possessed brand recognition and worldwide distribution. Kodak could bring new products to consumers’ attention and to support these products with one of the world’s best known and most widely respected brand names as a huge advantage in the market where technological change created uncertainty for consumers. Kodak’s brand reputation was supported by its massive. , worldwide distribution presence – primarily through retail photography stores, film processors, and professional photographers.

- Competitive Capabilities: Prior to 1990s Kodak had invested huge in R&D. Moreover, its century of innovation and development of photographic images gave Kodak tremendous depth of understanding of recording and processing images. Central to Kodak’s imaging capability was its color management capability. In the digitizing color and transferring digital images to paper, Kodak possessed a powerful set of complementary technologies in sensing, color management and thermal printing.

- Market advantage: Through its wider distribution network, it has been able to maintain a huge market coverage and accessibility. It had worldwide distribution presence – primarily through retail photography stores, film processors, and professional photographers.

Company’s competence and Competitive capabilities

- Competency: Eastman Kodak has been Leveraging competencies in film and paper media, color management. It has been known for the best quality films and cameras worldwide. Its journey of more than 100 years has helped to gain the experience and excel in its Endeavour. The organizational changes like decentralization and accountability that George Fisher made helped increase speed of manufacturing and product development .i.e short product development cycles. Secondly, a strength could be also considered Kodak’s favorable corporate image (and implicitly a significant brand equity) that results from the values which are said to lead the staff’s behaviors (“respect for the dignity of the individual, integrity, trust, credibility, continuous improvement and personal renewal, recognition and celebration”), a transparent management which allows shareholders to have a realistic and up-to-date image of the operations performed, strong Human Resources policies and commitment to the community.

- Core Competency: Eastman Kodak was a highly integrated company that did its own R&D and manufactured its own parts. Changing global markets and cost pressures in the 1980s and 1990s threatened the way of doing business. So the knowledge, company’s intellectual capital are also affected and repercussion is proficiency in its core competency started diminish. George Fisher, CEO in 1993, refocused the company on core competencies and joined the trend of outsourcing with close relationships to suppliers and announced a new explicit social contract as part of the restructuring effort. By 1997, the company could not grow out of its competitiveness problems like major price competition from its biggest international competitor, Fuji, which was engaged in a major price-cutting campaign aimed at increasing its market share internationally and particularly in U.S. markets. In response, Kodak made more significant changes designed to reduce its costs and to recapture market share in the company’s core products. But all these attempts only lead to decrease market share and declining profit.

- Distinctive Competency: Firstly, the brand image of the company that has been built since century is the distinctive competency for Kodak. Before the digital age, its distinctive competencies were film and Cameras and its sister concern for its chemical technology.

Strategies of Eastman Kodak

- Vertical integration combined with continuous innovation and product development. Speed is also required cutting cycle times in manufacturing and product development.

- To systematize and accelerate product development and improve product-launch, quality, Kodak introduced a new product development methodology called “Manufacturing Assurance Process”(MAP).

- Joint venture with HP, Microsoft to introduce new products that required in the market. Collaborate with expert to enhance the competency.

- Digital strategy was to create greater coherence among Kodak’s multiple digital projects.

- Previously they had diversification strategy but later Fisher focus in Imaging business.

Source: Scribd.com

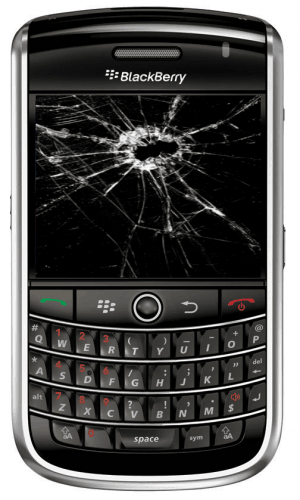

STRUGGLING WITH DISRUPTIVE CHANGE – RIM

The BlackBerry smartphone maker (RIM) is in deep trouble – but Apple was once in even worse trouble with even less time to fix it. Steve Jobs did bring Apple back from the edge of bankruptcy and today it is one of the most valuable companies in the world, but the speed of innovation is ever-faster. A company that’s fallen behind might never catch up. Will RIM (Blackbarry) catch up?

The company had been steadily selling phones up until late 2010 or early 2011, until its shipments began dropping steeply.

The sad fact is that all of this could have been avoided. The company was slow to act in the wake of Apple’s smartphone bombshell back in 2007, believing that consumers would always want a hardware keyboard.

STRUGGLING WITH DISRUPTIVE CHANGE – NOKIA

RIM it’s not the only company in trouble – Nokia is seeing similar drops in shipments.

Nokia phones were once a consumer favorite, but no longer. Other devices, including the Apple iPhone and Samsung Galaxy S smartphone, among many others, have captured consumers’ imagination. Consumers stuck around in support of Nokia for a while, but after they realized that the company wasn’t reacting very adroitly, they left, and they might not come back.

There was a time when they could count on the company to deliver the latest and greatest platform on the market. But over the last several years, it has been slow to react, and when it did offer products, they failed to appeal to the new customer. Now,consumers don’t know if they can trust Nokia’s claims that it will change all that in the coming years. That alone will be a difficult issue for Nokia to overcome.

There are many unflattering comparisons to make regarding Nokia’s current market capitalization. The struggling handset maker’s market cap is now lower than the $8.5 billion Microsoft Corp. paid for IP-telephony company Skype Ltd. last year. Nokia is valued at roughly seven times what Facebook paid for Instagram, and slightly more than half of Apple Inc.’s latest quarterly net profit.

STRUGGLING WITH DISRUPTIVE CHANGE – MICROSOFT

Once upon a time, Microsoft dominated the tech industry – indeed, it was the wealthiest corporation in the world. But since 2000, as Apple, Google, and Facebook whizzed by, it has fallen flat in every arena it entered: e-books, music, search, social networking, etc., etc.

The story of Microsoft’s lost decade could serve as a business-school case study on the pitfalls of success. For what began as a lean competition machine led by young visionaries of unparalleled talent has mutated into something bloated and bureaucracy-laden, with an internal culture that unintentionally rewards managers who strangle innovative ideas that might threaten the established order of things.

They used to point their finger at IBM and laugh – Now they’ve become the thing they despised – Bill Hill, a former Microsoft manager

Microsoft have now announced the Surface tablet. It seems nice. But in making the Surface, Microsoft played it safe and chose to compete, not disrupt.

The Microsoft iPad competes with ultra-thin notebooks and full blown PCs with a traditional keyboard and desktop OS, it competes against the Apple iPad, Android tablets, Amazon’s Kindles etc.

In choosing to compete, Microsoft blew it’s chance to create a stand-out tablet device that could challenge the iPad. And it’s a little too late.

Courtesy: http://www.torbenrick.eu/t/r/mur

STD - ISD - PCO Booth

Video Cassette Player & Cassette Rental

No comments:

Post a Comment