What is Angel Investment?

Angel investment refers to the early-stage investment made by individuals, known as angel investors or angel funders, into promising startup companies or ventures. These individuals typically invest their own personal funds, often in exchange for equity ownership or convertible debt in the startup.

Angel investment refers to the early-stage investment made by individuals, known as angel investors or angel funders, into promising startup companies or ventures. These individuals typically invest their own personal funds, often in exchange for equity ownership or convertible debt in the startup.

Angel investors are typically high-net-worth individuals who possess both financial resources and expertise in specific industries or markets. They invest in startups during their early stages when these companies often face challenges in obtaining traditional financing from banks or venture capital firms. Angel investors play a crucial role in bridging the funding gap for startups and providing them with the necessary capital to develop and grow their businesses.

In addition to financial support, angel investors often bring valuable knowledge, experience, and networks to the startups they invest in. They may provide mentorship, strategic guidance, and access to their professional connections, helping the startup to navigate challenges, refine their business models, and accelerate their growth.

Angel investments are typically considered high-risk investments due to the early-stage nature of the startups involved. However, they also offer the potential for high returns if the startup succeeds and achieves significant growth or attracts further funding from venture capital firms or other investors.

It's important for entrepreneurs seeking angel investment to prepare a compelling business plan, financial projections, and a compelling pitch to attract potential angel investors. Angel investors evaluate startup opportunities based on various factors, including the team's expertise, market potential, competitive advantage, scalability, and the potential for a successful exit in the future.

Overall, angel investment serves as a vital source of capital, mentorship, and support for early-stage startups, helping them turn their innovative ideas into viable businesses.

How to identify Angel Investors?

Identifying angel investors can be an important step in securing funding for your startup or business venture. Here are several ways you can identify potential angel investors:

1. Attend startup events and conferences:

2. Join startup incubators and accelerators:

Incubators and accelerators are programs designed to support and nurture early-stage startups. These programs often have networks of angel investors who actively invest in companies associated with the program. By joining an incubator or accelerator, you increase your chances of being connected to potential angel investors.

3. Utilize online platforms:

There are various online platforms that connect entrepreneurs with angel investors. Some popular platforms include AngelList, Gust, and SeedInvest. These platforms allow you to create a profile, showcase your business idea, and connect with potential investors. You can also explore crowdfunding platforms such as Kickstarter and Indiegogo, where angel investors sometimes browse for investment opportunities.

4. Tap into your existing network:

Leverage your personal and professional connections to identify potential angel investors. Talk to mentors, industry experts, and colleagues who may have connections with angel investors or may know someone interested in investing in startups. Attend industry events, meetups, and networking gatherings to expand your network and increase your chances of finding angel investors through referrals.

5. Research local angel investor groups:

Many regions have local angel investor groups or networks that facilitate investment in startups within their community. These groups may have websites or directories where you can find information about their members and investment criteria. Look for angel investor groups in your area and reach out to them directly to explore potential investment opportunities.

6. Engage with startup communities:

Engaging with startup communities, both online and offline, can help you discover potential angel investors. Join online forums, social media groups, and discussion boards focused on startups and entrepreneurship. Participate actively, seek advice, and build relationships. You may come across angel investors who are active members of these communities.

Remember, when identifying angel investors, it's essential to consider their investment focus, industry expertise, and geographic preferences. Tailor your approach and pitch to match their interests and increase the chances of attracting their investment. Be prepared to present a compelling business plan and demonstrate the potential return on investment for angel investors.

Some popular websites and platforms that can help you connect with angel investors:

AngelList (www.angel.co): AngelList is a widely-used platform connecting startups with investors. It allows you to create a profile, showcase your business, and connect with angel investors and venture capitalists. The platform also provides job listings and resources for startups.

Gust (www.gust.com): Gust is an online platform that connects entrepreneurs with investors. It provides tools for creating investor-ready profiles, managing investor relations, and conducting due diligence. Gust has a network of angel investors, venture capitalists, and startup programs.

SeedInvest (www.seedinvest.com): SeedInvest is a leading equity crowdfunding platform that connects accredited investors with startups seeking funding. Startups can apply to raise capital through equity crowdfunding campaigns and potentially attract angel investors through the platform.

Crunchbase (www.crunchbase.com): Crunchbase is a comprehensive database of companies, investors, and industry insights. While it is primarily used for research, it also provides a platform for startups to create profiles and connect with investors, including angel investors.

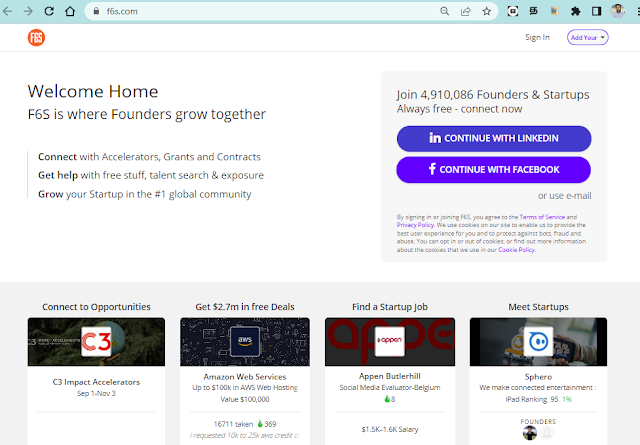

F6S (www.f6s.com): F6S is a global network for startups that offers various resources, including a database of angel investors. Startups can create profiles and connect with potential investors through the platform.

StartEngine (www.startengine.com): StartEngine is an equity crowdfunding platform that allows startups to raise capital by selling securities to a wide range of investors, including angel investors. It provides tools for creating campaigns, managing investments, and engaging with investors.

Republic (www.republic.co): Republic is an equity crowdfunding platform that connects startups with a community of investors. It allows startups to raise capital through crowdfunding campaigns, offering equity or revenue-sharing opportunities. Angel investors can discover and invest in promising startups through the platform.

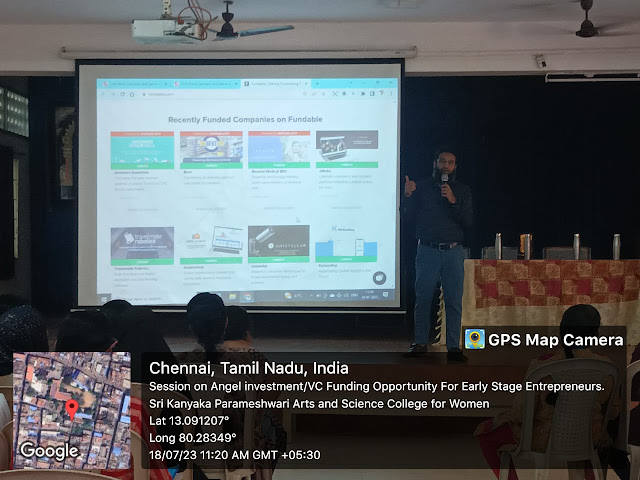

Fundable (https://www.fundable.com/): Fundable is a crowdfunding platform that allows startups to raise capital from both accredited investors and the general public. It offers various funding options, including equity crowdfunding and rewards-based crowdfunding.

AngelCapitalAssociation (https://www.angelcapitalassociation.org/): The Angel Capital Association (ACA) is not a direct networking platform, but it provides valuable resources and information about angel investing and a directory of angel groups that entrepreneurs can use to find potential investors.

Meetup (https://www.meetup.com/): While not specifically an angel investor networking platform, Meetup is a website where you can find local networking events, including those organized by angel investor groups. Attending these events can help you meet potential investors in person.

While these platforms can provide access to angel investors, building relationships and conducting due diligence is essential. Make sure to thoroughly research and vet potential investors before entering into any agreements or accepting funding.

Additionally, it's worth noting that some regions or countries may have local or specialized angel investor networks that may not be listed on these platforms. Researching and networking within your local startup ecosystem can help you identify such networks or groups

3 Common Myths About Starting A Business

Myth #1: You need a complete, elaborate, and detailed business plan from day one. ...

Myth #2: You need a lot of money to start. ...

Myth #3: You must be all about your business, 24/7

https://youtube.com/shorts/L5hFLLTrpo0?feature=share3

https://youtube.com/shorts/rWgQjepiRXQ?feature=share

https://youtube.com/shorts/nAr-vpwcgac?feature=share

Pitch Deck

The following is an outline and key components of a pitch deck to approach angel investors, it's important to note that there isn't a "perfect" pitch deck that fits all situations. The content and structure of your pitch deck may vary depending on your industry, stage of development, and specific investor preferences. However, here's a general guideline for a pitch deck:

Pitch Deck - Shark Tank African Food Products

Slide 1: Introduction

Company name and logo

Your name and position

Contact information

Slide 2: Problem Statement

Clearly define the problem your product or service solves

Explain the pain points and challenges faced by your target market

Provide data or real-world examples to support the problem statement

Slide 3: Solution

Explain how your product or service solves the identified problem

Highlight the unique features and benefits that differentiate your solution

Showcase any intellectual property or technological advancements

Slide 4: Market Opportunity

Present the size and potential of your target market

Share relevant market research and data to support your claims

Highlight any current trends or market gaps that your business can leverage

Slide 5: Business Model

Explain your revenue streams and pricing strategy

Describe your customer acquisition and retention strategies

Demonstrate the scalability and profitability of your business model

Slide 6: Competitive Analysis

Identify and analyze your key competitors

Highlight your competitive advantages and unique selling points

Showcase market traction or customer testimonials, if available

Slide 7: Marketing and Sales Strategy

Outline your marketing and sales approach

Describe how you plan to reach your target customers

Present any partnerships or distribution channels you have secured

Slide 8: Team

Introduce your key team members and their expertise

Highlight relevant industry experience and achievements

Emphasize the complementary skills that make your team capable of executing the business plan

Slide 9: Financials

Provide a summary of your financial projections, including revenue, expenses, and profitability

Highlight key financial milestones and growth projections

Showcase the potential return on investment for angel investors

Slide 10: Funding Requirements

Clearly state the amount of funding you are seeking

Explain how the funds will be used to drive growth and achieve specific milestones

Outline the potential exit strategies for investors, such as acquisition or IPO

Slide 11: Summary and Call to Action

Summarize the key points of your pitch

Reiterate the investment opportunity and potential for returns

Include your contact information and encourage investors to reach out for further discussions

Remember to keep your pitch deck concise, visually appealing, and easy to understand. Use high-quality visuals, charts, and graphs to support your claims. Practice your pitch and be prepared to answer questions and address potential concerns from angel investors.

No comments:

Post a Comment